1: Crypto Market Update – September 2025: The cryptocurrency market continues to gain strength as Bitcoin price holds firm above $115,000, supported by large-scale whale accumulation and renewed institutional interest. Ethereum is showing bullish momentum, crossing above $4,500 amid rising ETF inflows, while XRP breaks out of a long-term trendline as it aims for its $3.66 all-time high.

Let’s take a closer look at what’s driving the major players in the crypto space this week.

💰 Bitcoin Holds $115K As Whales and ETF Inflows Boost Confidence

Bitcoin (BTC) continues to trade near $115,000 after briefly topping $116,000 mid-week. The flagship cryptocurrency is being supported by both long-term holders and institutional investors, indicating strong market conviction.

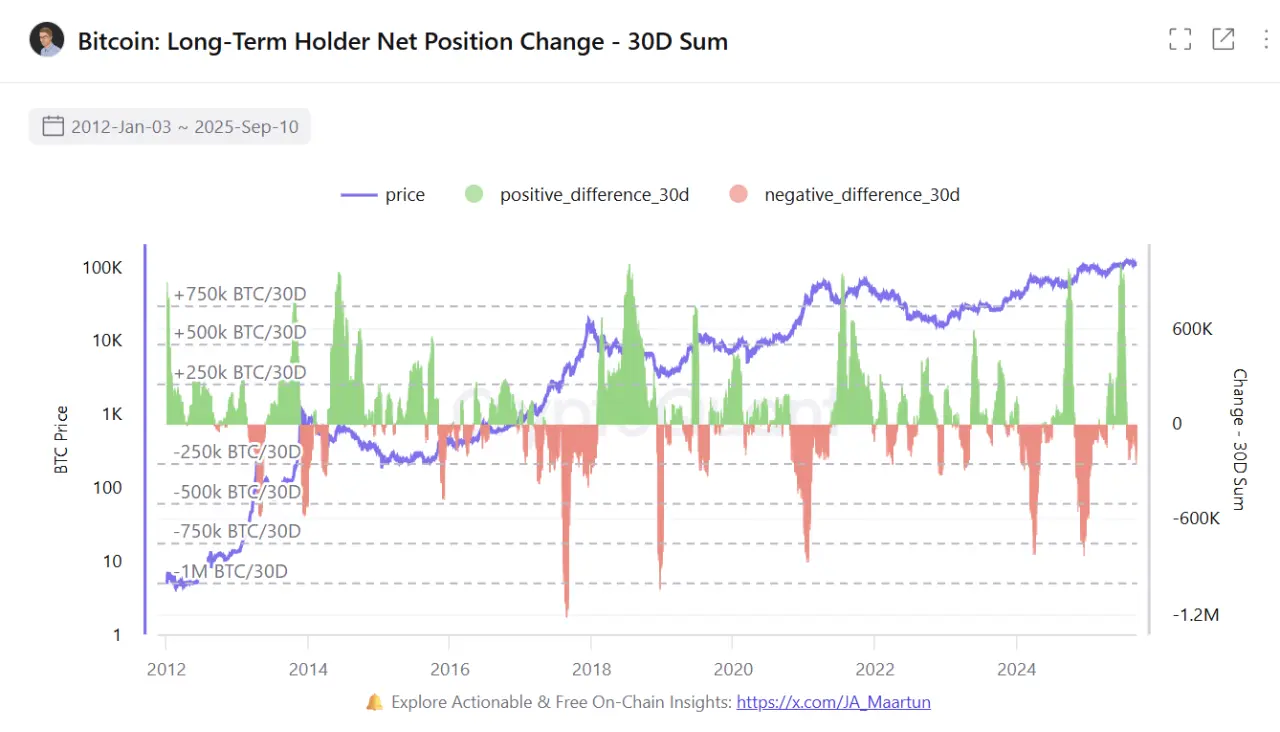

According to data from CryptoQuant and XWIN Research Japan, Bitcoin wallets holding between 100 and 1,000 BTC have accumulated over 65,000 BTC in the past 7 days. This cohort now holds a total of 3.65 million BTC, reflecting a steady rise in confidence among whales.

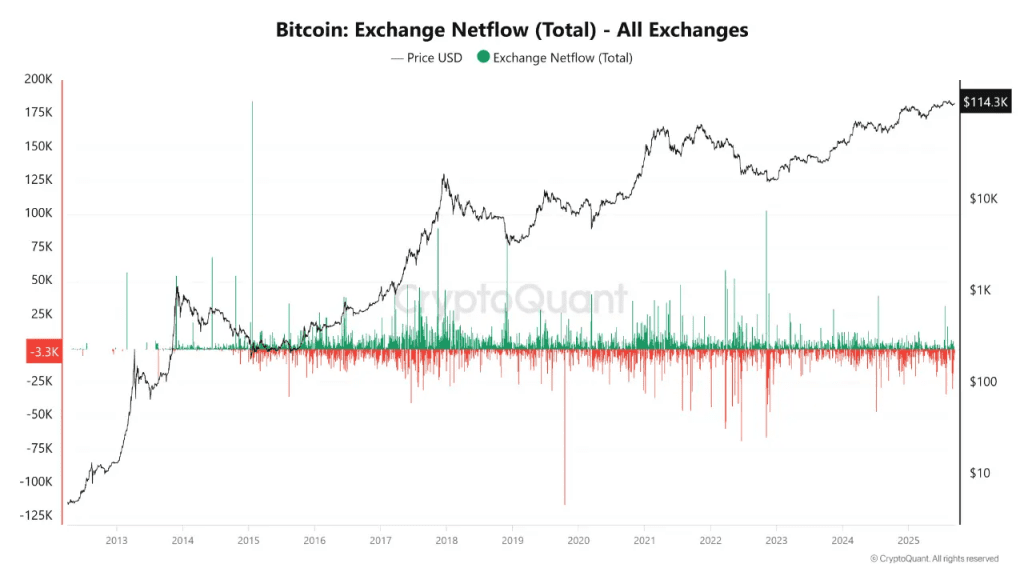

In addition, BTC exchange netflows have seen consistent net outflows, signaling that more investors are transferring coins into cold storage — often a bullish sign of long-term holding behavior.

🔎 ETF Inflows Add More Fuel

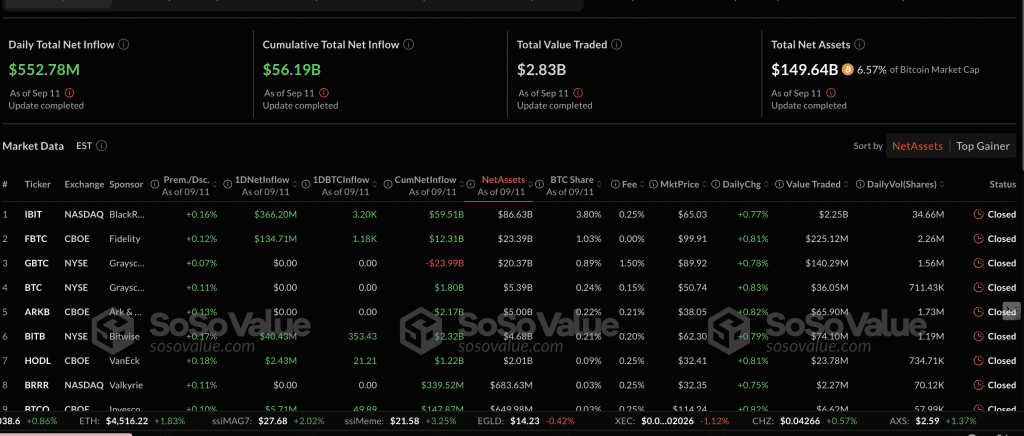

Spot Bitcoin ETFs in the U.S. have also seen a resurgence in demand. According to SoSoValue, BTC ETF inflows reached $553 million on Thursday alone, bringing the weekly total to $1.7 billion.

This strong institutional interest, especially ahead of the Federal Reserve’s interest rate decision next week, is pushing Bitcoin closer to its next psychological milestone at $120,000.

📈 Technical Outlook

Technically, Bitcoin remains in a bullish zone after reclaiming key levels:

- 100-day EMA: $111,012

- 50-day EMA: $113,117

- Support Level: $114,500

The MACD indicator has been flashing a buy signal since Sunday, while the RSI currently sits at 57, indicating a healthy — but cautious — uptrend. A daily close above $116,000 would further validate Crypto Market Updatethe push toward $120K.

🔗 Ethereum Reclaims $4,500 with Support from ETF Inflows

Crypto Market Update Ethereum (ETH) is also riding the bullish wave, now trading above $4,500. The smart contract leader is showing growing strength thanks to renewed investor confidence and rising demand for ETH ETFs.

After a short period of outflows, Ethereum ETFs in the U.S. have now registered Crypto Market Update three straight days of inflows. On Thursday alone, $113 million flowed into ETH ETFs, pushing cumulative inflows to $12.96 billion, and total assets under management to $28.51 billion.

🔧 Technical Picture

ETH maintains strong bullish momentum with:

- RSI: Rising, currently at 58

- MACD: Nearing a fresh buy signal

- Key supports:

- 50-day EMA: $4,126

- 100-day EMA: $3,680

If bulls maintain control, Ethereum could soon test its all-time high of $4,956 reached in August. Traders will likely increase exposure once the MACD confirms a bullish crossover.

🌊 XRP Breaks Trendline, Eyes $3.66 Record High

XRP (Ripple) is also showing strength after breaking above a Crypto Market Update three-month descending trendline, signaling the potential for a sustained recovery.

XRP is currently holding above crucial moving averages:

- 50-day EMA: $2.92

- 100-day EMA: $2.79

- 200-day EMA: $2.54

This technical setup supports the bullish case as XRP pushes toward Crypto Market Update key resistance at $3.35, with its all-time high of $3.66 in sight.

📊 Derivatives Market Shows Confidence

According to CoinGlass, XRP’s Crypto Market Update futures open interest rose to $8.51 billion on Thursday — up from $7.37 billion on Sunday. This suggests increasing confidence among traders betting on XRP’s recovery.

The MACD also continues to show a strong buy signal, reinforcing bullish momentum heading into the weekend.

📌 Conclusion: Momentum Builds Ahead of Fed Decision

Crypto Market Update The crypto market is clearly in a risk-on phase, with key indicators showing bullish momentum across Bitcoin, Ethereum, and XRP. Whether driven by whale accumulation, ETF demand, or favorable technical setups, the market seems poised for further gains — especially if macroeconomic conditions remain supportive.

Keep a close eye on:

- Bitcoin’s potential breakout above $116K

- Ethereum ETF flows and MACD crossover

- XRP’s next move toward $3.35 and possibly $3.66

Binance Futures Trading Resumes

📊 Market Sentiment: Risk Appetite on the Rise

As this crypto market update shows, broader investor sentiment is gradually shifting back into risk-on territory. Despite global macroeconomic uncertainty, the cryptocurrency sector is benefiting from growing confidence, especially from institutional players. The uptick in ETF inflows and on-chain activity indicates that many are positioning themselves for potential upside ahead of key economic events, such as the upcoming Federal Reserve interest rate announcement.

🏦 Institutional Demand Signals Long-Term Optimism

This crypto market update also underscores the increasing role of traditional finance in shaping crypto price trends. The cumulative $1.7 billion in Bitcoin ETF inflows and nearly $13 billion in Ethereum ETF assets under management reflect growing institutional belief in digital assets as part of long-term portfolios. This shift in market structure may help reduce volatility over time, particularly as more ETFs get approved and integrated into retirement accounts and institutional strategies.

🔮 What to Watch in the Next Crypto Market Update

Looking ahead, traders and analysts will be closely watching several catalysts in the next crypto market update. These include potential regulatory announcements, additional ETF filings, and macroeconomic indicators like CPI data or Fed guidance. In the meantime, as long as Bitcoin holds above key support and Ethereum and XRP maintain bullish momentum, the market appears poised for a continuation of the upward trend — possibly pushing BTC toward $120K and ETH toward new all-time highs.

Altcoin Momentum and Broader Market Trends

Beyond Bitcoin, Ethereum, and XRP, several altcoins are beginning to reflect the optimism captured in this crypto market update. Coins tied to Layer 2 solutions, DeFi protocols, and AI-driven blockchain projects are seeing increased trading volumes and investor interest. This broader altcoin momentum is a key sign that capital is rotating across the crypto ecosystem — often a precursor to a more sustained bull cycle. If current macro and technical trends hold, we could see a full-fledged altcoin season in the weeks to come.

Market Volatility Still a Factor to Watch

While the overall tone of this crypto market update is bullish, it’s important for investors to remain cautious in the face of short-term volatility. Rapid price swings—especially in highly leveraged derivatives markets—can trigger liquidations and unexpected pullbacks. Monitoring funding rates, open interest, and sentiment indicators like the Crypto Fear & Greed Index will be key to identifying when the market may be overheating or due for consolidation. Staying informed during such dynamic periods is essential for both short-term traders and long-term holders.

🌍 Macroeconomic Factors Shaping This Crypto Market Update

A critical aspect influencing this crypto market update is the broader macroeconomic environment. Global markets are currently navigating through a complex mix of inflation concerns, shifting interest rate policies, and geopolitical instability. These macro factors directly impact risk appetite, particularly for speculative assets like cryptocurrencies. With the Federal Reserve’s next interest rate decision looming, traders are anticipating how dovish or hawkish the Fed might be — a move that could trigger either a continuation of the rally or a short-term correction. As such, crypto investors are closely watching traditional markets, Treasury yields, and economic indicators like CPI and job reports to assess where the momentum is heading.

🧠 Smart Money Behavior: What Whales and Institutions Are Telling Us

In this week’s crypto market update, one of the strongest signals comes from the behavior of what analysts call “smart money” — large-scale investors, including crypto whales and institutions. The recent accumulation of over 65,000 BTC by wallets holding 100–1,000 BTC suggests these players anticipate further upside. Historically, such moves have preceded major price rallies. In parallel, the consistent net outflows from centralized exchanges indicate that both retail and institutional investors are moving assets into long-term storage, signaling reduced intent to sell. This “HODL” behavior often tightens available supply, potentially creating the conditions for a supply squeeze if demand continues to rise.

⚙️ Blockchain Upgrades and Network Growth Boost Confidence

This crypto market update isn’t just driven by price action — underlying blockchain fundamentals are strengthening as well. Ethereum’s growing dominance in decentralized finance (DeFi), the upcoming upgrades to Layer 2 scaling solutions, and Bitcoin’s improved Lightning Network adoption all reflect healthy network growth. Developers are continuing to innovate, particularly in areas like zero-knowledge proofs (ZKPs), rollups, and AI-integrated smart contracts. On-chain activity, wallet creation, and gas fee trends all show that user adoption is holding steady — even growing in some ecosystems. These technology improvements play a major role in driving long-term investor confidence and are key elements in this evolving crypto cycle.

🛡️ Regulation and Policy Outlook: A Major Catalyst for the Next Crypto Market Update

Any comprehensive crypto market update must consider the evolving regulatory landscape. The U.S. Securities and Exchange Commission (SEC), along with other global regulators, continues to shape the future of crypto through enforcement actions, ETF approvals, and legal decisions surrounding securities classification. While some jurisdictions are tightening rules, others — like Hong Kong, Singapore, and Switzerland — are creating crypto-friendly environments to attract innovation and capital. The long-awaited clarity around Ethereum ETFs and potential XRP regulatory wins could be game-changers for investor sentiment. As regulatory news unfolds, it will continue to influence both short-term market reactions and long-term structural adoption.

🔁 Correlations With Stocks and Global Assets: What They Mean for Crypto

A nuanced view in this crypto market update is the growing — but sometimes decoupling — relationship between crypto and traditional markets. Historically, Bitcoin and Ethereum have shown strong correlations with tech stocks and major indices like the S&P 500 or Nasdaq. However, recent moves suggest that crypto may be developing more independence, particularly when driven by sector-specific catalysts like ETF approvals or halving events. For instance, Bitcoin’s latest price action diverged from stock indices during a pullback in equities, signaling that crypto demand is increasingly driven by internal dynamics. Traders are now assessing these shifts to identify whether crypto can maintain its narrative as “digital gold” and a hedge in uncertain times.